The Steps to FINRA Arbitration

The Financial Industry Regulatory Authority (FINRA) is the governing body that handles disputes between its regulated members, which includes sellers of securities such as stockbrokers and brokerage firms, and their customers, clients and anyone else involved in any matter arising from the purchase or sale of securities, and even the management or advice given to a client.

When a securities dispute arises, FINRA arbitration can be time-saving and cost-effective, and it also may be required under the terms of your account agreement. Knowing the basics of how arbitration proceedings work will help you understand what to expect if you go forward with a claim.

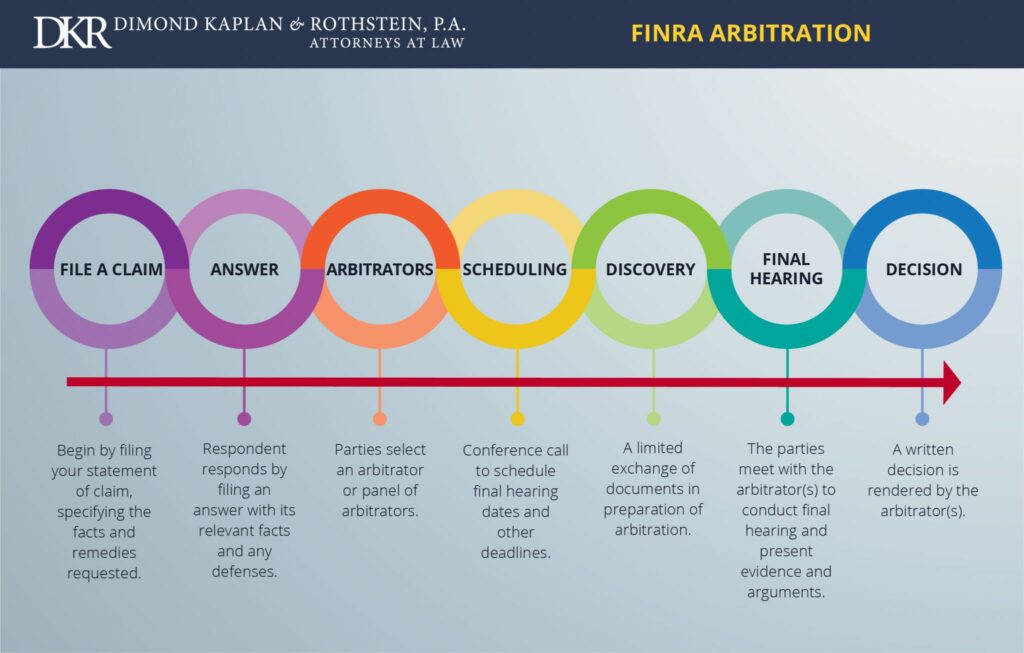

Understanding FINRA arbitration is important when dealing with fraud. The above flow chart provides a basic overview of how the FINRA arbitration process works. If you have any questions about what FINRA does, or believe that you have a valid claim against either your broker or brokerage firm, you should contact an experienced securities attorney as soon as possible. As is the case with other types of legal disputes, you will need to file your claim within a certain period of time in order to preserve your rights and possible remedies.

DKR Securities Fraud Attorneys Can Help

With offices in Los Angeles, New York, Miami and West Palm Beach, our securities lawyers have helped investment fraud victims throughout the U.S. recover more than $100 million from banks and brokerages firms for their wrongful actions.

Call a Securities Fraud Attorney Today

Contact a securities fraud attorney at Dimond Kaplan & Rothstein, P.A. today to schedule an appointment or consultation to review your rights and options.